Buying a fixer-upper can be a fantastic investment because fixer-uppers tend to be much more affordable than houses that aren’t in need of many renovations or repairs. But is it worth it?

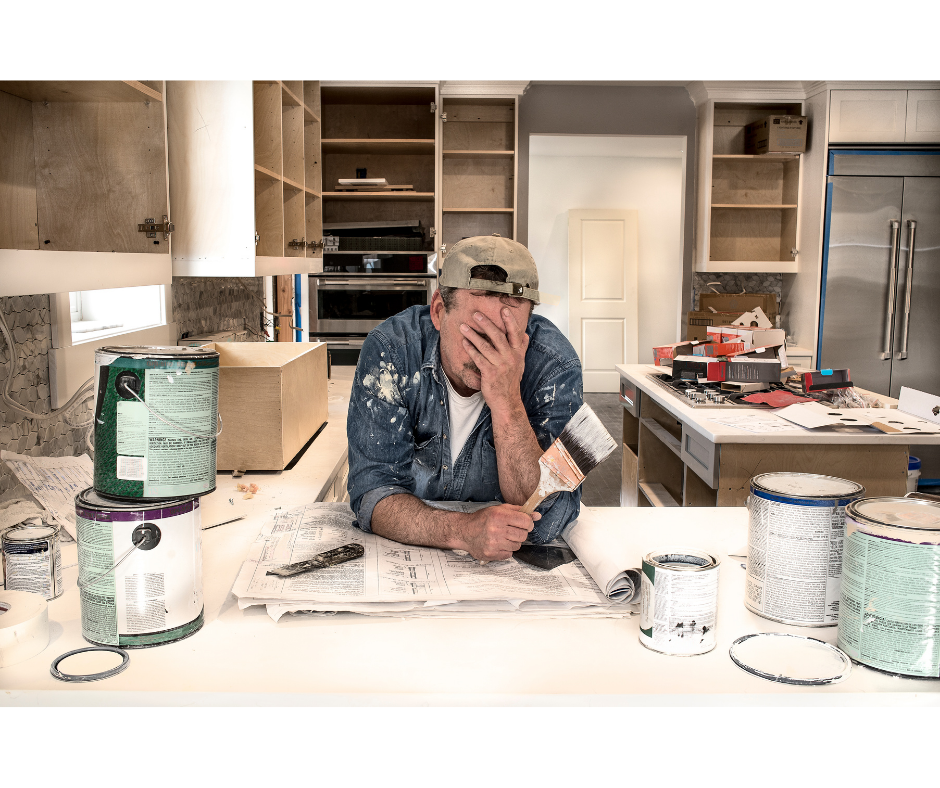

Many buyers will purchase fixer-uppers with the intention of flipping them for a profit. However, not every fixer-upper is a great deal. If you’re not careful, you could end up with a money pit. If you’re going to invest in a fixer-upper, whether it’s to flip the house for a profit, to rent the house out, or live in it yourself, make sure that you keep these six things in mind before you decide to buy.

1. THE LOCATION

There’s no point in investing thousands of dollars fixing up a house in a neighborhood full of abandoned buildings and overrun by criminal activity. It won’t matter how beautiful the house looks after the renovations, if the surrounding area is an undesirable area. Make sure it’s in a neighborhood where the buyer demand is high. It’s great when you’re in the position to buy the ugliest, most neglected house in a desirable neighborhood.

Additionally, don’t over-improve the property for the neighborhood. Improvements can only take you so far. An appraiser must find comparable properties to compare a sale to. If they can’t find comparable homes, it will hurt your value because they can’t ignore the market activity happening around your property.

2. THE FLOOR PLAN

When you’re touring a fixer-upper, remember that the floor plan matters. If the kitchen is upstairs and the only bathroom is in the basement, you’re going to have some serious remodeling on your hands. If the layout needs a bunch of modifications, this can take a big hit to your budget, and ultimately, your profit. The location of bedrooms, bathrooms- even laundry rooms!- can be a deal breaker for a lot of buyers.

3. THE CONDITION

There is a big difference in buying a house that needs to be repainted and buying a house where the roof needs to be replaced. Certain repairs are going to cost way more than the rest, making the low price of the house irrelevant. As you’re looking the house over, take notes of the types of repairs needed to determine the amount of money it would take to bring the house up to your and the neighborhood standards. If that total number over shoots the potential profit, then it’s probably not the right property.

4. THE CONFIGURATION

The number of bedrooms and bathrooms matter. It can be an absolute deal breaker for a buyer. A three-bedroom and two-bathroom fixer-upper is going to be a lot easier to flip than a two-bedroom and one-bathroom. Keep this in mind as you’re looking at potential fixer-uppers to invest in.

5. YOUR BUDGET

Nothing can impact profit more than who will be doing the work when you’re buying a fixer upper. There is a hug difference between a licensed contractor flipping a property, and an average home owner who needs to hire someone to do major repairs. If the needed repairs are mostly cosmetic and can be transformed with a little elbow grease, then great! But if the fixer-upper needs a new roof, sewer line and walls moved, then you need to factor all that work into the budget and measure it against the potential value those repairs will add to the home.

Even if you plan to do the work yourself, many improvements require permits, which can be costly and are very important when it comes time to resell the home. And if you’re planning to rent it out, getting the necessary permits for work completed will be beneficial in ensuring that the work was completed correctly and don’t include any liability issues down the line.

6. TIME REQUIREMENT

Take into consideration the amount of time you have to dedicate to making the necessary improvements. I often have to remind clients that we are not all Chip or Joanna- though don’t we wish we were- and working on repairs requires time, skill and money. If you don’t have an a ton of all those, than a fixer-upper might be more than your able to chew, but if you do, then tackling the fixer-upper project might just fulfill you in a whole new way!

Buying a fixer-upper can be super exciting and rewarding, or completely deflating and disappointing. Make sure that you assess your life, your goals, and your budget. If after assessing, you know this is the right step for you, start the search for you next fixer upper here.

Leave a Reply